Traditional financial systems, often a patchwork of disconnected tools and legacy software, frequently fall short in meeting these demands. As a result, inefficiencies and data silos proliferate, causing redundant processes and delayed access to critical financial data. These issues make it nearly impossible for organizations to respond quickly to changing market conditions, posing challenges to …

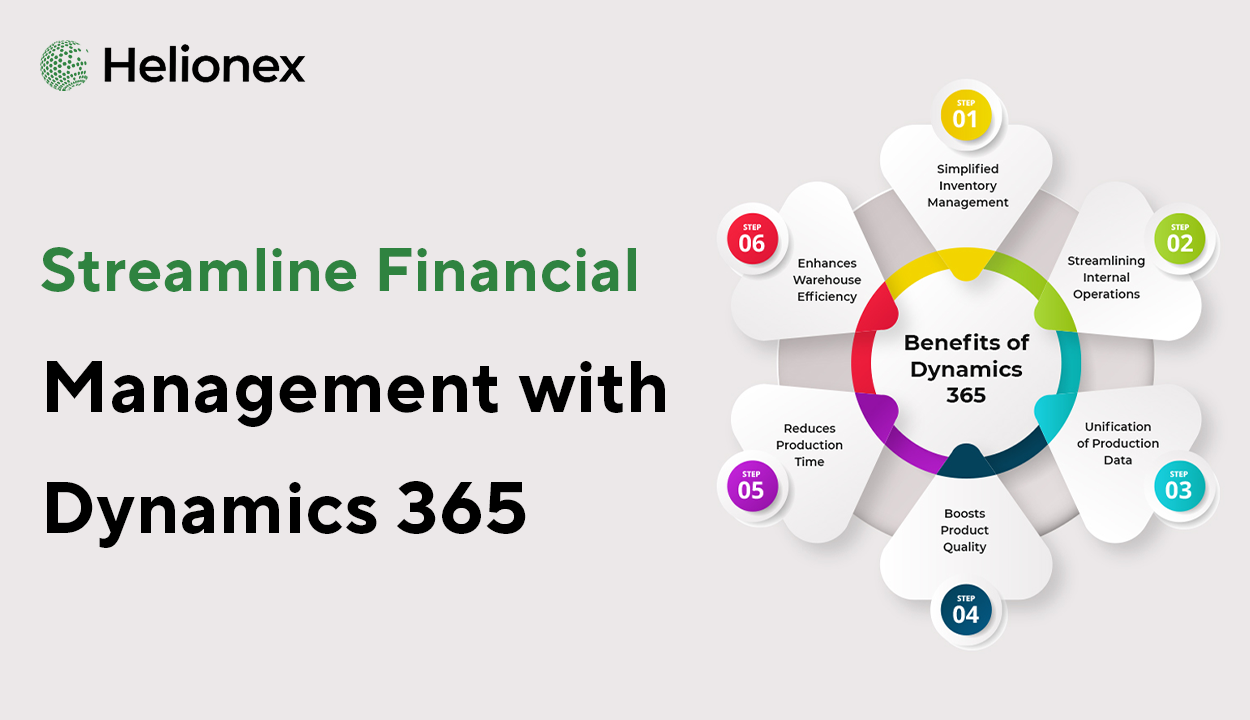

How to Streamline Financial Management with Microsoft Dynamics 365

To streamline financial management in a fast-moving business landscape, finance teams must overcome mounting pressure to manage global operations, comply with complex regulations, and deliver real-time insights all while reducing operational costs. The demands placed on modern finance professionals are higher than ever. Not only are they expected to close books faster and provide accurate financial statements, but they also must anticipate business needs, deliver crucial data for decision-makers, and ensure every process aligns with global compliance standards.

Traditional financial systems, often a patchwork of disconnected tools and legacy software, frequently fall short in meeting these demands. As a result, inefficiencies and data silos proliferate, causing redundant processes and delayed access to critical financial data. These issues make it nearly impossible for organizations to respond quickly to changing market conditions, posing challenges to growth and profitability. This is where Microsoft Dynamics 365 Finance & Operations (D365 F&O) steps in to streamline financial management, offering a unified, intelligent platform that transforms every aspect of financial operations across the enterprise.

Unify Operations to Streamline Financial Management

One of the core benefits of D365 F&O is its ability to consolidate all essential financial processes into a single integrated system. This consolidation includes accounts payable and receivable, budgeting, asset management, general ledger, tax compliance, and cash flow management. By eliminating fragmented data sources, organizations finally achieve a centralized view of their financial health. This vantage point is not just about visibility it’s about accuracy, coherence, and empowering finance professionals to spot trends and irregularities quickly.

For instance, a multinational manufacturer leveraging D365 F&O can unify the financial operations of subsidiaries in different countries. Previously, this might have required manual reconciliation and data transfer at month’s end, leading to errors and time delays. D365 F&O automatically consolidates and standardizes all transactions, ensuring that data from each entity is instantly available for group-level reporting. This unified approach to streamline financial management improves accuracy, visibility, and control across multiple entities and geographies, enabling finance leaders to operate with confidence and agility.

Gain Real-Time Insights

Real-time visibility into your organization’s financial performance is a game changer. D365 F&O’s integrated analytics powered by Power BI place real-time dashboards and BI tools directly in the hands of finance professionals. With access to up-to-the-minute information on cash flow, profitability, revenue, and costs, leaders can make informed decisions faster than ever before.

For example, if a retail chain identifies an unexpected dip in profit margins within a specific region, D365 F&O provides drill-down capabilities. Finance managers can instantly explore the underlying transactional data, isolate the cost drivers, and work with operations to address issues before they balloon into major setbacks. This granular, real-time access streamlines financial management by replacing guesswork with data-driven clarity and fostering a proactive business culture.

Being proactive rather than reactive is crucial for modern organizations. With traditional systems, by the time reports are available, the data is often outdated. D365 F&O’s real-time insights allow you to adapt your strategy swiftly, responding to market changes or internal developments with confidence.

Simplify Global Complexity

Managing international operations introduces a host of challenges, from exchange rate fluctuations to varying compliance frameworks across geographies. D365 Finance is engineered precisely to address these complexities. With native support for multi-currency transactions, multi-language interfaces, and multi-legal entity management, the platform caters to the needs of both global giants and companies expanding abroad.

Automated features are integral to streamlining financial management across borders. For example, foreign currency revaluations are processed at the click of a button, and financial consolidations spanning subsidiaries in multiple countries are handled automatically according to local and global requirements. Intercompany transactions and eliminations, which often require cumbersome manual entries in legacy systems, are efficiently managed within D365 F&O, ensuring seamless reporting and auditable records.

Moreover, local tax and compliance regulations are continuously updated in the system, reducing the risk of errors and penalties for noncompliance. Imagine a finance team supporting operations in Europe, Asia, and North America: D365 F&O delivers configurable tax codes, VAT handling, and statutory reporting out of the box. This reduces the time spent on tax administration and allows finance teams to focus on value-added tasks that further streamline financial management globally.

Boost Efficiency with Intelligent Automation

Automation is at the heart of streamlining financial management with D365 F&O. The system’s comprehensive workflow engine replaces repetitive manual tasks with streamlined, automated processes. Consider invoice processing: In traditional setups, invoices might need to be manually entered, reviewed, approved, and paid a process prone to errors and bottlenecks. In D365 F&O, incoming invoices are automatically matched with purchase orders, routed to the appropriate approvers via configurable workflows, and paid electronically.

Payment runs, bank reconciliations, and ledger postings are similarly automated. The benefits are significant: errors are reduced, time is saved, and finance professionals can focus on more strategic work like analysis, planning, and business partnering. For a large services firm, automating these financial operations through D365 F&O has resulted in days saved per month during month-end closes, freeing up the team to provide better support for business units.

Recurring journal entries, fixed asset depreciation, and budget allocations are other commonly automated financial processes, ensuring that no critical transaction is ever missed. Automation in D365 F&O doesn’t only improve efficiency; it leads to higher morale and greater job satisfaction among finance staff by reducing burnout from tedious, repetitive work. This human-centric benefit is often overlooked but is crucial in retaining top talent in accounting and finance departments.

Enhance Security and Centralized Control

Streamline financial management is not just about speed or efficiency it’s also about reducing risk. With an ever-growing landscape of cyber threats and increasing regulatory scrutiny, finance teams need solid internal controls and robust audit trails. D365 F&O is built with enterprise-grade security in mind, featuring role-based access control, multifactor authentication, and continuous monitoring.

Sensitive operations such as payment authorizations and supplier onboarding can be restricted to appropriate staff, while all actions are logged for full traceability. The system ensures that only the right people can access or modify financial data, minimizing the risk of fraud or data leakage a vital component of streamlined financial management for modern organizations.

Ensure Compliance and Audit Readiness

Compliance and audit readiness are effortlessly integrated into the DNA of D365 Finance. The platform offers extensive controls to ensure adherence to both local and global regulatory standards, such as Sarbanes-Oxley (SOX), International Financial Reporting Standards (IFRS), and Generally Accepted Accounting Principles (GAAP). Segregation of duties, mandatory audit trails, and compliance workflows give organizations the confidence that policies are enforced at every step.

For example, if a public company must demonstrate control over financial reporting to external auditors, D365 F&O provides detailed logs and automated documentation. Auditors can trace transactions from initiation to final posting, clearly seeing all approvals and changes. Automated control frameworks reduce human error, speed up year-end audits, and dramatically reduce business risk an essential part of any initiative to streamline financial management.

Improve Strategic Planning Through Advanced Forecasting

Strategic planning is a foundational pillar of financial management. D365 F&O revolutionizes this area through powerful budgeting and forecasting tools, allowing organizations to model multiple scenarios, evaluate the impacts of market events, and build reliable, data-driven forecasts. By using built-in AI and machine learning capabilities, finance teams can explore “what-if” analyses, spot emerging trends, and make critical business decisions well in advance.

For instance, a consumer goods company can simulate the financial implications of expanding into a new geographic market, factoring in exchange rates, projected sales, and operating costs. These projections are immediately reflected in budgets and cash flow forecasts, helping business leaders allocate resources wisely. The result: smarter long-term strategies and the ability to pivot quickly as conditions evolve, further streamlining financial management.

Seamless Integration for an End-to-End Solution

One of D365 F&O’s most compelling advantages is its interoperability with the broader suite of Microsoft tools Excel for data analysis and reporting, Power BI for business intelligence, Teams for real-time communication, and Power Automate for advanced workflow automation. This interconnected ecosystem enhances productivity by allowing users to work in familiar interfaces and reducing the need to switch between separate software platforms.

For example, a financial analyst preparing a complex variance report can export data directly to Excel, manipulate it using advanced formulas, and share findings instantly through Teams. If approvals are needed, Power Automate can trigger workflows and notifications, ensuring the process is seamless and timely. By reducing the friction inherent in disconnected processes, D365 F&O further streamlines financial management and empowers teams to achieve more with less effort.

Real-World Success Stories: How Organizations Streamline Financial Management

Numerous organizations across industries and regions have successfully leveraged D365 F&O to streamline financial management and drive transformation. For example:

- A global pharmaceutical company used D365 F&O to standardize and automate its financial processes across more than 20 countries. Month-end close time was reduced from two weeks to five days, and real-time dashboards gave executives immediate access to consolidated reports.

- A leading logistics firm replaced its aging ERP and manual spreadsheets with D365 F&O, resulting in automated invoice processing and payment runs. This reduced manual intervention by 70% and improved cash flow visibility.

- A retail chain expanded its operations internationally and benefited from the multi-currency and regulatory compliance features of D365 F&O, allowing it to move into new markets without the usual financial reporting headaches.

These real-world examples show how streamlining financial management goes beyond mere efficiency it enables innovation, rapid growth, and a stronger competitive edge.

Best Practices to Streamline Financial Management with D365 F&O

For organizations seeking to maximize the value of their investment in Microsoft Dynamics 365, adopting best practices is key:

- Define Clear Objectives: Before rolling out D365 F&O, clarify what “streamline financial management” means for your organization. Do you want to reduce manual tasks, accelerate reporting, improve compliance, or a mix of all three?

- Invest in Training: Ensure finance teams are thoroughly trained on both the platform and new business processes. Leverage Microsoft’s extensive e-learning modules, community forums, and hands-on workshops.

- Prioritize Data Cleansing: Migrate only clean, accurate data into D365 F&O. Historical errors and duplications can undermine the integrity of your new system.

- Leverage Automation: Automate wherever possible approve payments, route invoices, reconcile bank accounts, and set up recurring journal entries. Regularly review processes for further automation opportunities.

- Integrate with Other Systems: Take advantage of D365 F&O’s APIs and connectors to integrate with your CRM, HR, and supply chain tools, building an enterprise-wide platform that delivers fully streamlined financial management.

The Future of Streamlined Financial Management

The world of finance is rapidly evolving. Cloud technology, automation, and AI are set to redefine how organizations manage their finances in the coming years. D365 F&O is leading the transformation by providing a scalable, secure platform that grows with your business needs. As more organizations embrace digital transformation, the expectation will shift towards finance departments serving as strategic advisors identifying growth opportunities, anticipating risks, and driving operational excellence.

Streamlining financial management is not just a matter of operational efficiency; it’s about unlocking new value, empowering teams, and building resilience. The organizations that invest in modernizing their financial management infrastructure today will be the leaders of tomorrow.

Conclusion: The Benefits of Streamlining Financial Management

Streamline financial management with Microsoft Dynamics 365 offers far-reaching benefits from faster closing cycles and improved accuracy to stronger compliance, better resource allocation, and increased agility. By unifying operations, enabling real-time insights, simplifying global complexity, automating manual processes, and ensuring compliance, D365 F&O ensures that finance organizations are not just keeping pace with change but leading it.

At Helionex, we specialize in implementing D365 F&O to help finance teams modernize their operations. If your organization is ready to streamline financial management and embrace the future of intelligent ERP, get in touch. Greater efficiency, deeper insights, and enhanced value await when you choose to streamline your financial management processes with Microsoft Dynamics 365.